Turn tax time into dinner time for Wisconsin families

| Comments

That old saw to "Beware the Ides of March" may have been simply a warning that the tax man is looming.

But in Wisconsin, you shouldn't beware the ides of March because this year, as in years past, you can turn tax time into dinner time for Wisconsin families through the Wisconsin Tax Check Off program.

The program helps you easily donate a portion of your state tax refund to our network of regional food banks in Wisconsin. Our food banks are wholly owned, operated and supported by everyday families living throughout our great state and we depend on your generosity in order to ensure that our friends and neighbors have access to the healthy and nutritious food they need to work, learn and live healthy lives.

It's really easy. If you use tax preparation software like TurboTax, an option to donate to local charities will come up toward the end of your state return.

Simply select "Hunger Relief" or "Feeding America" and voila, you're done. TurboTax will even remember your donation for your charitable deduction next year!

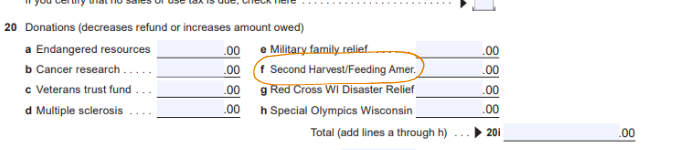

If you are filling out the Wisconsin state tax return forms, you can find the option, option "F," to donate on line 20 of the short form or line 53 on the long form.

Funds will be distributed between the Feeding Wisconsin food banks by the percentage of the state that each one serves. Our food banks provide food resources, technical assistance, and grants to over 1,000 affiliated food pantries and meal programs in all 72 counties of our state. We have statewide impact and deep local reach.

For every dollar that you donate, our food banks can provide at least 3 meals to the families that visit local food programs.